March Is National Oral Health Month!

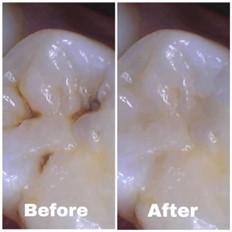

Why Do You Need To Get a Cavity Treated or Filled if It Does Not Hurt?

Easy New Years Dental Resolutions!

October Is National Dental Hygiene Month!

Do You Have Sensitive Teeth?

What’s the Difference? Types of Retainers After Orthodontic Treatment

New Year, New Smile!

Leesburg Family & Cosmetic Dentistry Holds Toy and Clothing Drive for Children in Need